However, you typically only have a limited period, such as 30 days from the statement date, to catch and request correction of errors. Once you’ve completed the balance as per the bank, you’ll then need to work out the balance as per the cash book. At times, you might give standing instructions to your bank to make payments regularly on specific days to third parties, such as insurance premiums, telephone bills, rent, sales taxes, etc. Direct debit payments of $500 automatically deducted from the account. Errors could include omission, entering the wrong amount, or recording an item to the incorrect account. Subtract any drawn checks that have been written to make a payment but not yet cleared by the bank.

Deposits in Transit

For example, if you issue a check to a supplier at the end of the month, it might not clear until the following month. After receiving a bank statement dated 31 December 20×1 for a checking account at First National Bank, the accountant for Sample Company began the reconciliation process. Expenses such as overdraft fees or monthly bank fees need to be deducted from your cash balance.

Data Processing Errors

To reconcile them, deduct any service fees from your book balance while adding any interest income. Next, dive into your bank statement to find transactions not yet reflected in your company’s books. Look for items such as bank fees, wire transfer fees, and interest income. These transactions might not have been recorded in your books yet because they occurred after your last update. As for outstanding checks, you’ve recorded them in the books, but they haven’t cleared in the bank account.

Performing Reconciliations on a Set Schedule

The need and importance of a bank reconciliation statement are due to several factors. First, bank reconciliation statements provide a mechanism of internal control over cash. It’s imperative to maintain detailed sets of records of the current reconciliation process and any adjustments made. Each step of the reconciliation process should be clearly recorded, including any discrepancies found and the actions taken to resolve them. This practice not only aids in internal reviews but also provides an audit trail.

Do you own a business?

- Some people rely on accounting software or mobile apps to track financial transactions and reconcile banking activity.

- If you want to prepare a bank reconciliation statement using either of these approaches, you can use the balance as per the cash book or balance as per the passbook as your starting point.

- When he receives the bank statement for one of the business accounts, a checking account, he sees that it has an ending balance of $9,800 while the company’s book balance shows $10,500.

- You’ll also need to make an adjustment if you notice that a not-sufficient-funds (NFS) check hasn’t cleared.

In addition, there may be cases where the bank has not cleared the checks, however, the checks have been deposited by your business. Banks take time in clearing checks, so the bank needs to add back the check’s amount to the bank balance. In addition, there may be cases where the bank has not cleared the cheques, however, the cheques have been deposited by your business. Banks take time in clearing cheques, so the bank needs to add back the cheque’s amount to the bank balance. From the following particulars of Zen Enterprises, prepare a bank reconciliation statement as of December 31, 2023.

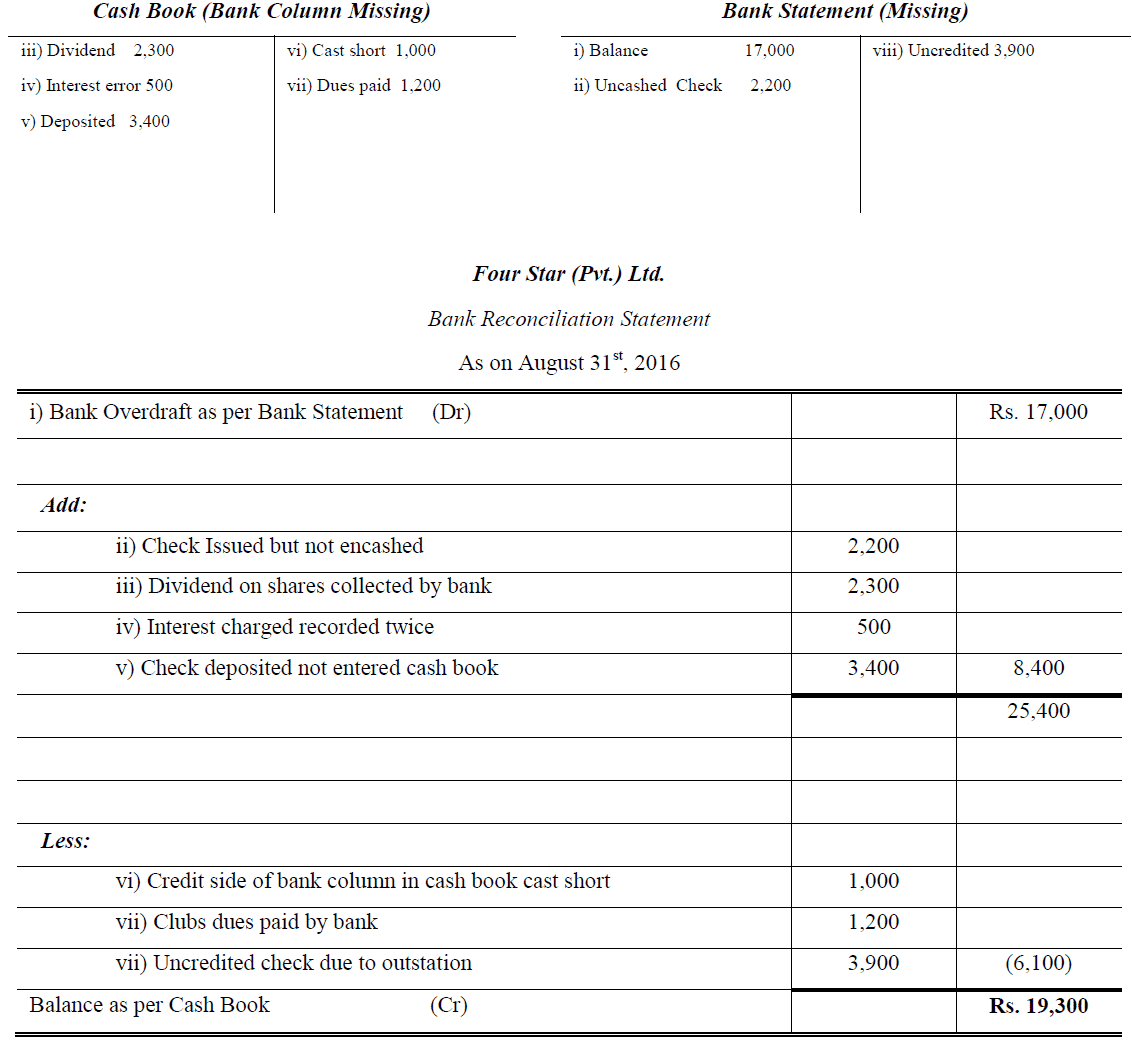

Bank reconciliation statement:

If both the balances are equal, it means the bank reconciliation statement has been prepared correctly. Theoretically, the transactions listed on a business’ bank statement should be identical to those that appear in the accounting records of the business, with matching ending cash balances on any given day. A bank reconciliation statement is prepared by a depositor meet the xerocon brisbane team (account holder) to overcome differences in the balances of the cash book and bank statement. Doing bank reconciliations regularly helps companies control their financial transactions and easily track errors and omissions. A bank reconciliation statement should be completed monthly but can even be done weekly if your company processes a large number of transactions.

And if you’re consistently seeing a discrepancy in accounts receivable between your balance sheet and your bank, you know you have a deeper issue to fix. If there’s a discrepancy between your accounts and the bank’s records that you can’t explain any other way, it may be time to speak to someone at the bank. In huge companies with full-time accountants, there’s always someone checking to make sure every number checks out, and that the books match reality. In a small business, that responsibility usually falls to the owner (or a bookkeeper, if you hire one. If you don’t have a bookkeeper, check out Bench). If not, you’re most likely looking at an error in your books (or a bank error, which is less likely but possible). If you suspect an error in your books, see some common bank reconciliation errors below.

Here are a few reasons why reconciling your bank statements is so important. Reconciling your bank statements won’t stop fraud, but it will let you know when it’s happened. Bank reconciliation helps to identify errors that can affect estimated tax payments and financial reporting. After including all the amounts identified in Step 3, your statements should display the same final balance. If any discrepancies cannot be identified and reconciled, it may signal an error or risk of fraud which your company can investigate further.

She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn. All of your bank and credit card transactions automatically sync to QuickBooks to help you seamlessly track your income & expenses. Dividends amounting to $1,335 received directly from an investment account.